We were just saying in Anti-Poverty Week how our housing system, in the absence of a genuine housing policy, enriches some while it impoverishes others – now the Grattan Institute puts some numbers on the problem.

The Institute's report, 'Renovating Housing Policy' looks at the cost and allocation of subsidies provided by Australian governments and delivered through the private housing system.

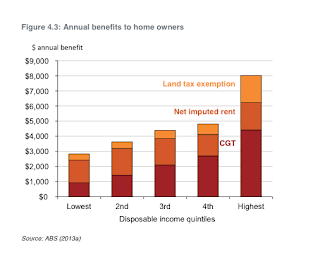

The winners are home owners, recipients of $36 billion (on average, $6100 per household) in tax expenditures and other benefits each year. These subsidies come from the exemption of owner-occupied housing from capital gains tax, land tax, income tax (on imputed rents), and the assets test for the Age Pension, and the First Home Owners Grants. Take a bow, home owners.

Runners-up are the landlords, recipients of $6.8 billion (on average, $4500 per household) in subsidies per year. These subsidies come from our generous tax treatment of capital gains and negative gearing.

And limping in in third place: private renters, whose Commonwealth Rent Assistance is worth, on average, $2900 per household per year.

All in all, more than 90 per cent of housing subsidies go to property owners. Some further dimensions of the inequity of our housing system are also made clear in the report.

First, rates of home ownership are declining, particularly amongst younger and lower-income households, so access to these subsidies is concentrating amongst older households and higher-income households.

Secondly, amongst owner-occupiers and landlords, the largest subsidies go to the households with the highest incomes.

The report concludes with a call for the renovation of housing policy, including such sensible measures as a broad-based land tax, a reduction in the preferential treatment of negative gearing and capital gains, and tenancy law reform to improve tenants' security and freedom of choice (for example, the choice to keep a pet).

A final thing: you might wonder where social housing fits in housing subsidy league table. The report doesn't say, but according to the most recent data from the Australian Institute of Health and Welfare, of public housing households who receive a rental rebate, the average amount is just under $6300 per year. Which puts their level of housing subsidy just ahead of most home owners, but still behind the level of subsidy that goes to homeowners in the top 20 per cent by incomes.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Please keep your comments PC - that is, polite and civilised. Comments may be removed at the discretion of the blog administrator; no correspondence will be entered into. Comments that are abusive of individual persons, or are sexist, racist or otherwise offensive will be removed, so don’t bother leaving them.

Note: Only a member of this blog may post a comment.